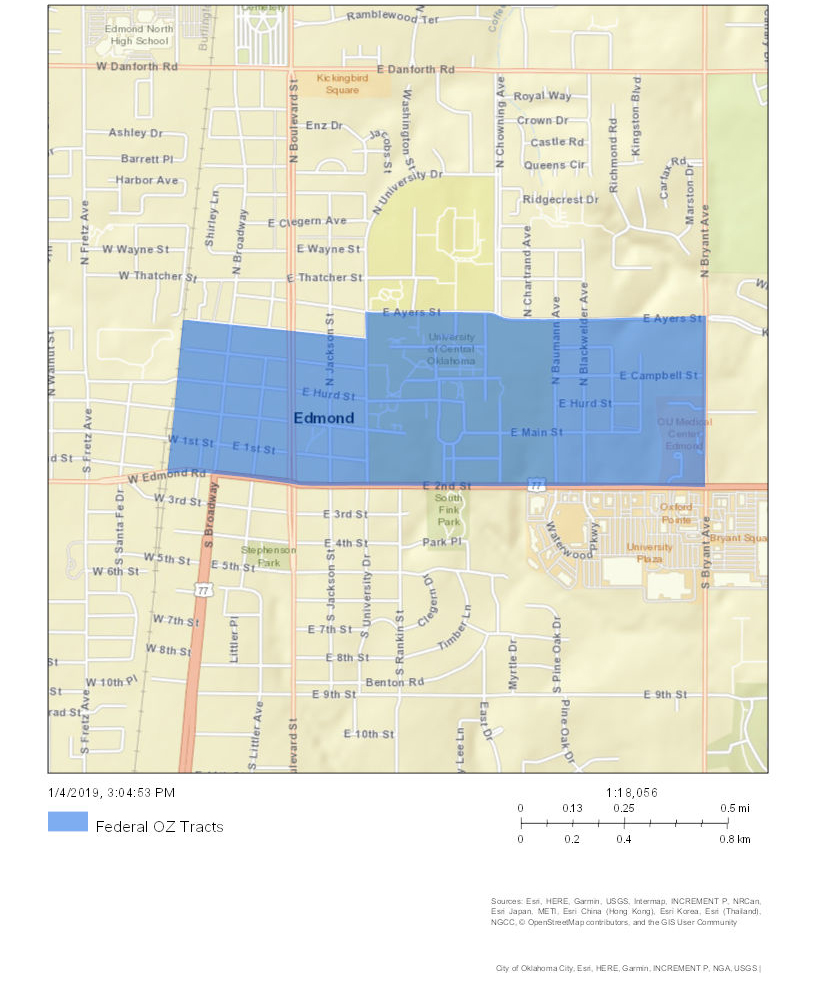

Edmond Opportunity Zones

At the end of 2017, Congress passed the Tax Cuts and Jobs Act (HR 1) which contained a provision to create Opportunity Zones in each state. Federal Opportunity Zones are a new community development program intended to spur investment in impoverished and economically distressed areas. Oklahoma was one of the first 15 states to designate Opportunity Zones.

This is a federal incentive that benefits local and state investors. By investing in an Opportunity Zone, through a qualifying Opportunity Fund, investors can defer and/or reduce their federal capital gains tax liability. If an investor’s capital is left in a qualifying fund for 5 years, the investor will defer their federal capital gains taxes. In the fifth year, the investor can reduce their capital gains tax. There is an additional reduction in year 7. If they leave the money in the fund for 10 years, then any appreciation in the asset from the time they invest through 10 years is not subject to any additional capital gains tax. This deferral and/or reduction on federal capital gains taxes will improve return on investment and also direct capital to areas that need investment.

Edmond, OK Federal Opportunity Zone